Valuation of Marketing-Related Intangibles: Trade Name – A UK Perspective

- Posted by admin

- On August 28, 2024

- 0 Comments

Introduction

A trade name, also known as a brand name, is the official designation under which a company operates its business. It serves as the distinguishing identifier for a brand or business in the market. The importance of a trade name lies in its ability to foster brand recognition, cultivate customer loyalty, and differentiate a business from its competitors.

Take, for instance, the trade name “Google,” which has become synonymous with internet searches and tech innovation. Google’s name, logo, and even its simple yet powerful search bar design has solidified its position as a leader in the tech industry. Similarly, “Coca-Cola” not only represents a beverage company but also evokes a sense of tradition and nostalgia, strengthened by its distinctive red and white logo and classic bottle shape. These elements together enhance the brand’s identity and market presence.

Trade names can represent significant value in business combinations and are often recognized as marketing-related intangible assets under IFRS 3: Business Combination. This recognition is crucial in assessing whether a trade name should be included separately from goodwill in a business acquisition.

Should You Recognize the Trade Name in a Purchase Price Allocation as per IFRS 3?

To determine whether a trade name should be recognized separately from goodwill in a business combination, the acquirer should assess whether the asset meets either of the following criteria:

- Contractual-Legal Criterion: Trade names that receive legal protection through registration or other methods fulfill the contractual-legal requirement. Whether registered or not, as long as the trade name is legally safeguarded, it should be acknowledged as an independent intangible asset.

- Separability Criterion: In instances where a trade name lacks legal protection but there is evidence of similar sales or exchanges involving comparable assets, it satisfies the separability criterion. In such scenarios, the trade name should be distinguished and separately recognized from goodwill during the process of purchase price allocation.

Accounting Requirements for Trade Names

- Initial Recognition: Trade names acquired in a business combination are capitalized (separately from goodwill) at fair value as per IFRS 3 guidelines.

- Useful Life: The estimation of the useful lives of trade names generally depends on factors like contractual or other legal terms, plans for the use of the assets, and the cost of renewing the lives of the assets. The useful life of a trade name could change or terminate prematurely due to various factors such as alterations in operating plans, brand strategy, business acquisitions, divestitures, and legal proceedings. Typically, there are no restrictions on the renewal of trade name registrations over time, which often results in trade names being regarded as having an indefinite life unless the company intends to discontinue their use in the near future.

- Impairment Assessment: If a trade name is classified as an indefinite-life intangible, it is not amortized but is annually tested for impairment as per IAS 36: Impairment of Assets. The value of a trade name acquired during a business combination is influenced by numerous factors, including the revenue generated by the trade name, discount rates, useful life assumptions, applicable royalty rates, profit margins, associated risks, and prevailing market conditions.

Trade names are valued using a range of methods. These methods can be broadly classified into three general approaches: income, market and cost approaches.

Table 1: Valuation Approaches for Trade Names

| Approach | Value indication | Information |

|

Income approach |

Present value of future economic benefits from use of the trade name rights. |

· Earnings forecast

· Reasonable royalty rates · Contributory assets |

| Market approach | Observable transactions of similar trade name rights. | · Transactions of similar trade name rights |

|

Cost approach |

Cost a market participant would incur if they were to create the utility of the asset themselves. |

· Historical costs

· Costs to replicate utility · Price Index · Obsolescence assumption |

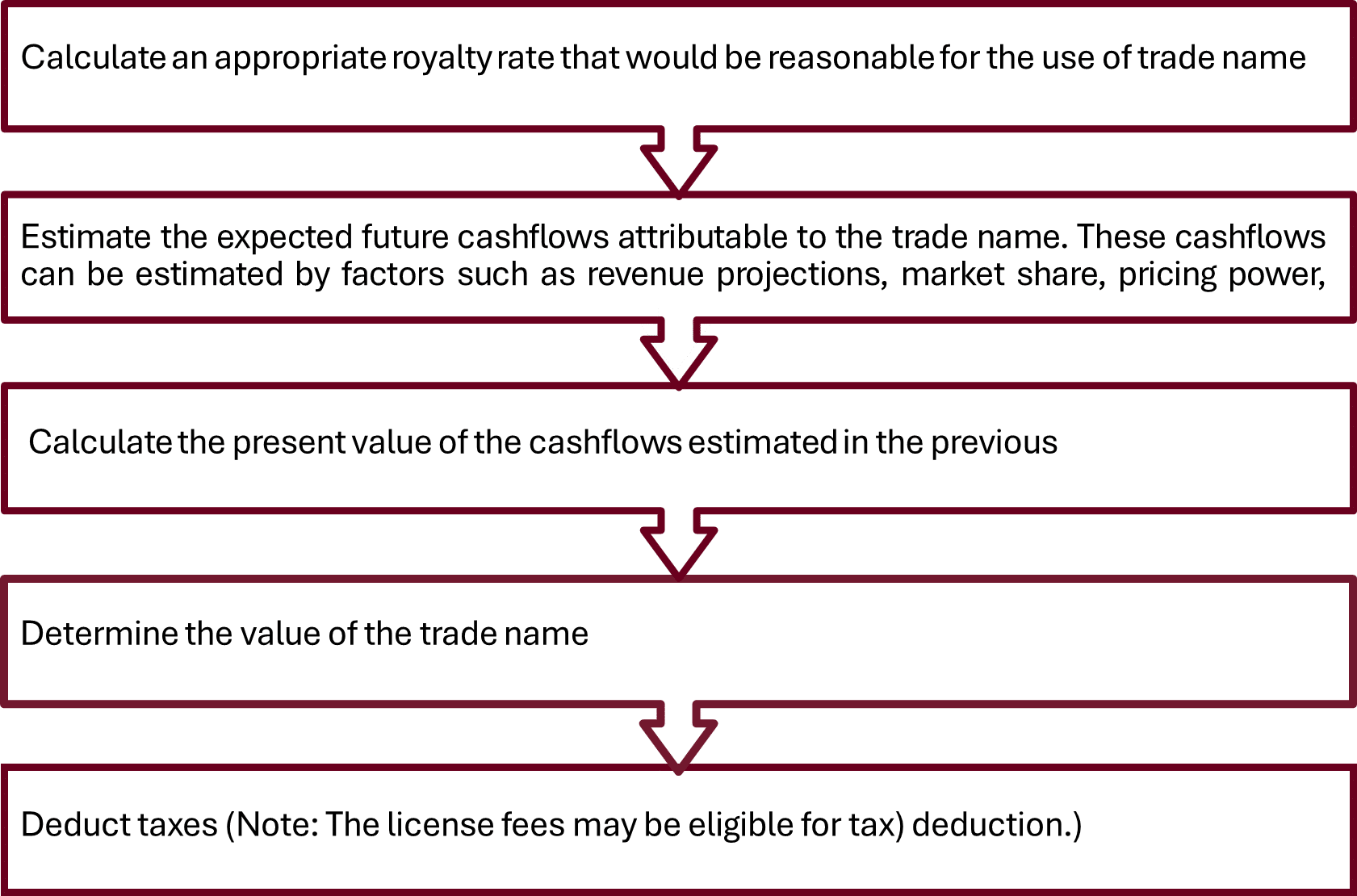

Valuation Guidelines: Relief from Royalty Method

One prevalent method for valuing trade names is the Relief from Royalty (RFR) method, a variant of the income approach. It estimates the expected royalty savings attributable to the ownership of the intangible asset. The fundamental principle is that if a user does not own a particular intangible asset, they would have to make periodic payments to the owner for the privilege of using that asset. The fair value of the asset is determined by calculating the present value of the license fees saved through ownership, commonly referred to as “royalty savings.”

To effectively utilize this approach, it is crucial to establish a hypothetical royalty rate that accurately reflects the comprehensive rights of use for comparable intangible assets. Utilizing readily available market data, such as observed royalty rates from real arm’s length licensing agreements, is preferred over relying on subjective and unobservable inputs. These market royalty rates can be obtained from various third-party data vendors and publications.

Steps for RFR method

Formula for calculating the value:

Current value = ∑T 𝑅𝑜𝑦𝑎𝑙𝑡𝑖𝑒𝑠 ÷ [1 + 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑟𝑎𝑡𝑒] 𝑡

“T” is the expected lifespan of the trade name (in years), and “t” is a single year

Illustration of RFR Method:

- Assumptions:

- Royalty rate: 1%

- Discount rate: 15%

- Tax: 38%

- Remaining useful life: 5 years

| Description | 2017 | 2018 | 2019 | 2020 | 2021 |

| Revenue | 20,000 | 22,000 | 23,650 | 24,833 | 25,577 |

| Growth | 10.00% | 7.50% | 5.00% | 3.00% | |

| Pre-tax royalty savings | 200 | 220 | 237 | 248 | 256 |

| Less: Taxes | (76) | (84) | (90) | (94) | (97) |

| After-tax royalty savings | 124 | 136 | 147 | 154 | 159 |

| Present value factor | 0.93 | 0.81 | 0.71 | 0.61 | 0.53 |

| Present value of savings | 116 | 111 | 103 | 94 | 85 |

| Sum of PV of savings | 509 |

Conclusion

The valuation of trade names involves considering numerous factors, including the company’s earning power, customer perception, and overall industry standing. While the outlined points provide a foundation for trade name valuation, there are no universally recognized rules for this process. Valuing intangible assets often relies on experience, common sense, and reasoned judgment, which are essential guides in these situations.

0 Comments