Revolutionizing Audit & Advisory – Unleashing the Power of AI for Future Success at Accounting Firms

- Posted by kalyani

- On March 26, 2024

- 0 Comments

The audit landscape is currently undergoing a significant transformation, driven by the integration of machine learning. This integration has resulted in a notable surge in productivity and accuracy. Historically reliant on sampling methods, traditional auditing faced challenges in encompassing comprehensive information and dealing with the laborious nature of manual processing. The introduction of machine learning, a specific facet of Artificial Intelligence (AI), now empowers audit firms to automatically sift through extensive datasets, pinpoint anomalies, and flag high-risk transactions for subsequent human analysis.

Machine learning, being a crucial component of AI, furnishes audit tools with algorithms and models that facilitate pattern recognition, prediction, and continual improvement based on data. In contrast to conventional AI approaches, where tools and systems are explicitly programmed with rules, machine learning systems learn from data. They undergo training on datasets, and their performance improves with exposure to more examples.

Types of Audits

External Audit

External audits, synonymous with financial audits, involve an examination of an entity’s financial statements by an external auditor, such as an accountant, the IRS, or a tax agency. Financial statement audits adhere to generally accepted auditing standards (GAAS) and focus on ensuring the accuracy of accounting records. Key areas of concentration for external auditors include segregation of duties, authorizations, approvals, as well as reviews and reconciliations.

Internal Audit

Internal audits, also known as operational audits, evaluate risks and internal controls within operational systems for specific departments, units, or business functions. Unlike external audits, the scope of internal audits is broader, encompassing elements that impact organizational objectives, with a focus on identifying areas for improvement.

Compliance Audit

Compliance audits independently assess whether an organization adheres to internal or regulatory standards, such as corporate bylaws, controls, policies, and procedures.

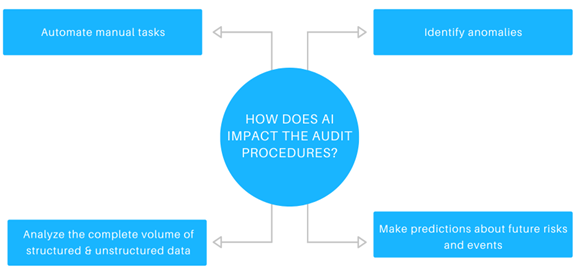

Impact of AI on Audit Procedures

The integration of AI has ushered in a paradigm shift in audit procedures, revolutionizing the traditional methods and significantly enhancing efficiency. Here’s a concise exploration of how AI impacts audit procedures:

Illustration1: Infographic: Impact of AI on Audit Procedures

Source: https://research.aimultiple.com/ai-audit/

Automation of Manual Tasks

AI facilitates the automation of routine and manual tasks traditionally performed by auditors. This includes tasks like documentation, checklist-based procedures, and data entry. By automating these repetitive processes, auditors can redirect their focus to more value-added activities, such as strategic analysis and decision-making. No longer confined to the periphery of financial oversight, auditors have become pivotal figures, guiding businesses toward sustainable financial practices.

Comprehensive Data Analysis

Traditionally, auditors grappled with extensive data sets, often overwhelmed by the sheer volume of information. With its computational capabilities, AI excels at handling extensive datasets swiftly and accurately. Tasks that were once time-consuming for auditors, such as reconciliations and pattern recognition, are now executed seamlessly by AI algorithms. This not only saves time but also empowers auditors to engage in more in-depth and critical data analysis.

Anomaly Detection

AI-driven auditing excels at identifying anomalies such as unusual payments or activities that may elude detection in manual auditing processes. It is particularly adept at identifying anomalies and irregularities in large volumes of transactional data. By continuously monitoring financial transactions in real-time, AI algorithms can quickly flag unusual patterns or activities that may indicate fraud or other risks. This proactive approach enables organizations to take timely action, safeguarding financial integrity and minimizing potential losses.

Predictive Analytics

The transformative power of AI extends to predictive analytics, enabling auditors to move beyond historical data analysis. AI empowers auditors to anticipate future financial trends, risks, and opportunities. This visionary capability elevates the audit process from a retrospective exercise to a strategic tool that helps businesses navigate uncertainties and make informed decisions.

Case Study

Consider a scenario where a traditional audit identifies a decline in a company’s profit margins. AI-driven analytics goes a step further, uncovering the underlying micro- and macro-economic factors contributing to this trend. Armed with granular insights, auditors can not only recommend strategies to reverse the decline but also guide businesses in fortifying their approaches against future market fluctuations. This strategic advisory role is a testament to the transformative impact of AI on audit practices.

There are further ways in which AI can enhance Advisory and Audit processes-

Risk Assessment

AI utilizes advanced algorithms to evaluate and quantify risks within an organization’s financial operations. By analyzing diverse data sources, including historical financial data and market conditions, AI identifies potential risks and prioritizes them. This proactive risk assessment enhances decision-making, reduces financial uncertainties, and contributes to the stability of an organization’s financial strategies.

Automation of Reconciliation

AI-driven algorithms automate the reconciliation process, comparing and matching financial records between different sources. This reduces the need for time-consuming manual efforts, saving time and minimizing errors. The automation of reconciliation processes enhances financial accuracy, improves internal controls, and provides a clearer understanding of an organization’s financial position.

Tax Compliance and Optimization

AI ensures organizations adhere to tax regulations while optimizing their tax strategies. Systems automatically calculate taxes owed based on intricate tax codes, reducing the risk of non-compliance. AI can analyze financial data to identify potential tax-saving opportunities, helping organizations minimize tax liabilities legally. This use case simplifies complex tax processes, mitigates risks, and maximizes tax efficiency.

AI-enabled Blockchain Auditing

AI can be instrumental in auditing transactions conducted on blockchain platforms, identifying potential instances of fraud and security vulnerabilities. This application of AI contributes to bolstering transparency and security within blockchain-based financial systems. Algorithms analyze extensive datasets to identify high-risk areas, allowing auditors to focus on samples most likely to contain errors. This optimization enhances the effectiveness of audits, providing a more comprehensive and reliable assessment of an organization’s financial integrity, compliance, and risk management.

Advisory Services

AI-driven robo-advisors analyze clients’ financial goals, risk tolerance, and current situations to provide tailored investment strategies and financial plans. These automated services offer cost-effective and efficient financial advice, empowering individuals, and businesses to make informed decisions about savings, investments, retirement planning, and wealth management.

Regulatory Compliance

AI-powered regulatory compliance ensures organizations meet evolving financial regulations and legal requirements. Continuous monitoring and analysis of data help organizations align with the latest regulations, reducing the risk of violations, fines, and legal issues. This use case enhances compliance efficiency, accuracy, and transparency, contributing to a more robust and secure financial environment.

Continuous Monitoring

AI enables continuous monitoring of an organization’s financial transactions, processes, and systems in real-time. Through techniques like machine learning and predictive analytics, AI systematically analyzes vast amounts of data to detect irregularities as they occur. This proactive approach enhances risk management, internal control, and compliance, providing a comprehensive and timely assessment.

In essence, AI doesn’t diminish the role of auditors; it amplifies their expertise. AI’s impact on audit procedures is transformative, enhancing efficiency, accuracy, and strategic decision-making. The shift from manual tasks to automated processes allows auditors to focus on higher-value activities, positioning auditors as strategic advisors to businesses. Embracing AI in audit procedures not only optimizes the audit process but also equips organizations with valuable insights for navigating an increasingly complex business landscape, guiding businesses toward resilience, profitability, and strategic growth.

Conclusion

As AI continues to redefine the advisory and audit landscape, practitioners must navigate this transformative journey strategically and responsibly. While the benefits are substantial, acknowledging and addressing associated challenges is crucial. With the right approach and insights, advisory and audit firms can leverage AI to not only meet but exceed client expectations, positioning themselves at the forefront of innovation in the industry.

0 Comments