Redefining UK Assurance: The FRC’s 3-Year Strategy for Excellence

- Posted by admin

- On May 13, 2025

- 0 Comments

- Business growth strategy, Fundraising valuation, IPO preparation, Startup valuation

In a world where trust is the currency of economic prosperity, the role of regulators like the UK Financial Reporting Council (FRC) cannot be overstated. By setting the rules and enforcing compliance, regulators safeguard the integrity of financial systems, ensuring that markets remain stable, transparent, and attractive to investors. A robust regulatory framework protects stakeholders and acts as a catalyst for economic growth, fostering innovation and resilience.

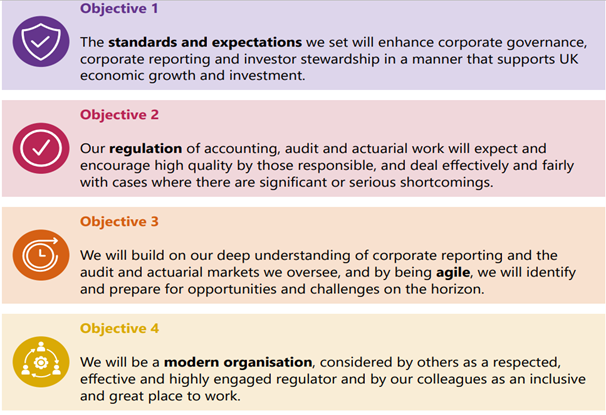

As the FRC unveils its 3-Year Strategy for 2025-28, it underscores the profound impact that well-crafted regulations can have on the economy at large. Built upon four key objectives—setting and driving high standards, ensuring effective regulation, promoting market understanding, and achieving organizational excellence—this strategy aims to redefine assurance practices in the UK.

The Four Objectives: Vision and Impact

Source: FRC 3-Year Strategy 2025-28

Setting and Driving High Standards:

The FRC seeks to enhance corporate governance, financial reporting, and stewardship standards. This involves aligning UK accounting practices with global benchmarks while addressing unique market dynamics. The aim is to:

-

- Promote greater transparency and accountability.

- Ensure financial information is reliable and robust.

- Strengthen trust among investors and stakeholders.

Impact: Accounting firms aligning with these standards will enhance their reputations and gain a competitive edge globally. However, this requires rigorous internal assessments and an unwavering commitment to quality.

Ensuring Effective Regulation: The FRC aims to refine its regulatory approach to become more risk-based and proactive. Key aspects include:

-

- Tailoring oversight to address firm-specific risks.

- Updating guidance to address emerging challenges.

- Strengthening enforcement mechanisms to uphold compliance and deter malpractice.

Impact: This fosters accountability and reduces systemic risks, compelling accounting firms to strengthen risk management frameworks and adopt best practices.

Promoting Market Understanding:

To adapt to a rapidly evolving financial ecosystem, the FRC emphasizes:

-

- Leveraging insights into corporate reporting trends.

- Identifying and preparing for emerging opportunities and challenges.

- Supporting informed decision-making by stakeholders.

Impact: Firms that stay attuned to market dynamics will be better equipped to anticipate changes and respond effectively, ensuring continued relevance and success.

Achieving Organizational Excellence: The FRC is committed to positioning itself as a modern and inclusive regulator by:

-

- Attracting and retaining top talent.

- Promoting diversity, equity, and inclusion within its operations.

- Embracing innovation to enhance regulatory processes.

Impact: This ensures that the FRC’s initiatives are effective and sustainable, creating a ripple effect of excellence across the assurance industry.

Preparing for the Future: Steps for UK Firms

UK accounting firms must adopt a forward-thinking approach to respond to these objectives effectively.

Key strategies include:

- Implementing Robust Governance Practices: Align internal governance structures with enhanced standards set by the FRC. This includes regular reviews and updates to governance policies to ensure compliance and transparency.

- Strengthening Risk Management Frameworks: Develop and integrate risk-based methodologies across all operations. Prioritize resources to address high-risk areas and align processes with the FRC’s proactive regulatory approach.

- Enhancing Financial Reporting and Audit Quality: Invest in tools and training to ensure financial reports meet the FRC’s elevated standards. Focus on precision, consistency, and reliability to build stakeholder confidence.

- Promoting Sustainability and Market Insights: Build capabilities to integrate sustainability practices into operations and reporting. Stay informed on market trends and emerging opportunities to remain competitive and responsive to change.

- Fostering a Culture of Excellence and Inclusion: Commit to attracting diverse talent and fostering an inclusive workplace. Embrace innovation to enhance productivity and regulatory compliance, ensuring organizational resilience.

KNAV Comments

When regulators prioritize continuous improvement as the foundation for maintaining quality, it instills a non-negotiable standard among all stakeholders: quality becomes an expectation, not an option. This unwavering focus on excellence drives innovation, accountability, and trust. The implementation of the UK FRC’s 2025-28 strategy will not only shape UK accounting firm practices but also define success for those firms ready to adapt and lead. The strategy aims to foster a robust financial ecosystem capable of addressing contemporary challenges by focusing on enhanced standards, evolved supervision, innovation, and governance. This is a call to action for firms globally: embrace these changes not as mere compliance measures but as opportunities to lead, innovate, and thrive in a dynamic market. The commitment to excellence and adaptability will define the accounting industry’s success in the years to come.

0 Comments