IR35 Legislation and Its Impact

- Posted by kalyani

- On May 15, 2024

- 0 Comments

In the UK, the responsibility for categorising workers continues to rest with companies. The recent decision regarding the country’s off-payroll working regulations (IR35) stipulates that businesses are still required to determine whether a contractor should be classified as an employee, handle the associated tax obligations, and, when necessary, contribute to the worker’s national insurance.

Previously, contractors themselves determined their tax status as individuals or companies. However, since 2020, IR35 mandates that businesses (or clients) must ascertain the correct tax status of workers. This shift has placed many businesses at risk of misclassification and the ensuing repercussions.

Understanding the intricacies of IR35 tax legislation is crucial for companies to safeguard themselves legally and comprehend the extent of resources required to properly classify workers.

What is IR35 Legislation?

The IR35 legislation, officially known as the “Intermediaries Legislation,” is a set of tax rules introduced by HM Revenue and Customs (HMRC) in the United Kingdom. It is designed to tackle tax avoidance by individuals who provide their services to clients through an intermediary, such as a personal service company (PSC), but who could be considered employees for tax purposes.

IR35, originally introduced in April 2000, constitutes UK tax legislation designed to ensure that contractors appropriately contribute income tax and National Insurance contributions (NICs). Specifically targeting workers who operate as contractors but have structured themselves as limited companies or other intermediaries, IR35 aims to address situations where individuals, although effectively functioning as employees, attempt to classify themselves as self-employed to reduce their tax obligations.

For instance, a contractor might establish a limited company, often referred to as a ‘personal service company’ (PSC), through which they provide services to clients. Payments for services rendered are directed to the PSC, allowing the contractor to receive income through dividends.

This arrangement potentially enables individuals to minimise income tax and NICs obligations compared to traditional employment. Additionally, clients engaging these contractors may avoid employers’ NICs and responsibilities such as providing holiday pay and sick leave, which apply to direct employees.

The effects of IR35 legislation on businesses are substantial. The foremost implication is that businesses retain the responsibility of determining workers’ employment status for tax purposes. This entails the provision of a ‘Status Determination Statement,’ elucidating the rationale behind their determination.

Who is Affected by the IR35 Rules?

The IR35 rules impact workers who render their services through an intermediary, such as a Personal Service Company (PSC), as well as clients who receive services from these workers through their intermediary.

Additionally, agencies, including recruitment agencies that supply contractors to clients, may also fall under the purview of these regulations.

The responsibility for determining whether IR35 applies to a contract varies based on the client’s size. Public authorities and medium- to large-sized clients outside the public sector are now tasked with assessing whether contracted workers operating through their own intermediary fall inside or outside IR35. Contractors should obtain an employment status determination from their medium or large-sized client, along with the rationale behind it.

Small business clients are exempt from IR35 regulations. In such cases, contractors’ intermediaries are responsible for determining whether they fall inside or outside IR35 and must act accordingly.

If a contractor utilises a PSC, they may be responsible for determining their employment status for tax purposes.

Who Qualifies for Exemption from IR35?

Small businesses are exempt from IR35 regulations. This signifies that if a small business engages an individual for work, it is the responsibility of the contractor to ascertain whether they fall within or outside IR35, rather than the small business.

A small business is classified as meeting two or more of the following criteria:

- Annual turnover: Not exceeding £10.2 million

- Balance sheet: Not surpassing £5.1 million

- Number of employees: No more than 50 employees

Conversely, medium- and large-sized businesses are obligated to assess whether their contractors fall within IR35 guidelines.

Impact of IR35 on Businesses

If you fall into any of the following categories, IR35 in the UK will directly impact you:

- A client receiving services from a worker through an intermediary.

- An agency providing workers’ services through their intermediary.

- Operating in the public sector.

- A medium or large-sized business outside of the public sector.

Given that this encompasses a vast majority of businesses in the UK, misclassifying an individual’s employment status could result in unpaid taxes, penalties, or loss of benefits. To safeguard your business against fines or penalties, the initial step involves determining whether you fall within the scope of IR35 or not.

What Does It Mean to Be Inside IR35?

When a contract falls within the scope of IR35, it signifies that it is subject to the off-payroll working regulations, and HM Revenue and Customs (HMRC) classifies the worker as an employee for tax purposes.

If a contract is deemed inside IR35, the worker is obligated to pay income tax and National Insurance Contributions (NICs) akin to regular employees. Additionally, the individual becomes subject to Pay As You Earn (PAYE) taxation, with a portion of their earnings deducted each month.

For businesses engaging with individuals inside IR35, there is a requirement to match the national insurance payment to the government. Moreover, businesses bear responsibility if any discrepancies arise in these payments.

What Does It Mean to Be Outside IR35?

When a worker is classified as outside IR35, it indicates that HM Revenue and Customs (HMRC) considers them to be self-employed rather than an employee.

In such cases, the worker typically engages in defined projects, rather than ongoing contracts, markets their services, and works for multiple clients concurrently.

When engaging with a professional outside IR35, it is imperative that the contract clearly delineates their working practices with the business and specifies the scope of their services.

Understanding the rights and responsibilities of contractors outside IR35 is crucial for businesses to mitigate risks such as fines, lawsuits, and other potential damages.

The Impact of IR35 on Independent Contractors

It’s crucial to recognise that IR35 contractors are not recognised as employees for tax purposes. Independent contractors in the UK are obligated to register for Self-Assessment to fulfill tax obligations and contribute to National Insurance.

However, as a business, your primary obligation lies in accurately determining the employment status of the worker. Unlike employees, your company isn’t mandated to provide insurance or handle tax obligations for contractors.

That being said, there are methods available to ensure the accurate classification of the individual.

Understanding IR35 in Practice

To grasp the implications of correctly determining a worker’s status, let’s examine the distinctions between inside IR35 and outside IR35:

Inside IR35 – Your business is required to match the income tax and national insurance contributions paid by the worker. Incorrect payments may render your business liable, potentially resulting in penalties and fines.

Outside IR35 – HMRC categorises the worker as a contractor, making them responsible for ensuring that their business pays the appropriate amount of national insurance and tax on their earnings. Your business is not obligated to implement PAYE in this scenario.

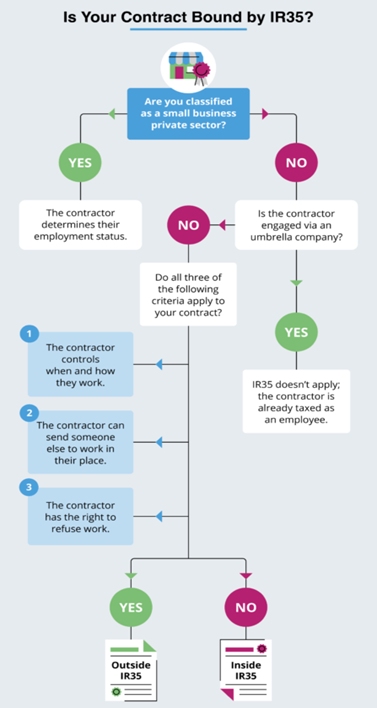

Illustration: Infographic- IR35 Flowchart

Source: https://velocityglobal.com/resources/blog/ir35-legislation/

IR35 mandates that individuals deemed or disguised as employees, referring to contractors who would be considered employees if they provided services directly to the client without an intermediary, should contribute the same amount of income tax and National Insurance contributions (NICs) as regular employees.

Clients, with the exception of small, private-sector businesses, who engage contracted workers, are tasked with determining:

- The employment status of these workers

- Whether their work contract falls under IR35 regulations

In the event of an investigation by HM Revenue and Customs (HMRC) resulting in a determination that a deemed employee has been misclassified, the responsibility falls upon the employer to settle any evaded taxes.

Case Study

Here’s an example of successful implementation of IR35:

Alice manages payroll at a large multinational company in England. After undergoing training on employment status and off-payroll working rules, Alice meticulously reviewed each contract with workers providing services through personal service companies. She assessed which workers would be affected by the new rules.

During her contract evaluations, Alice identified that Harvey’s contract fell under the off-payroll working rules. She promptly arranged a meeting with him to discuss the changes and their impact. Alice provided Harvey with a Status Determination Statement (SDS) clearly stating his employment status for tax purposes and the rationale behind it.

Alice then forwarded the SDS to the agency supplying Harvey’s services. The agency, following IR35 compliance, placed Harvey on PAYE and deducted income tax and National Insurance contributions before disbursing payments for his services. This approach ensured IR35 compliance for all parties involved.Now, let’s consider the same scenario with non-compliance:

Alice, still overseeing payroll, opted against formal training, and instead made blanket assessments for workers receiving services through agencies.

In Harvey’s case, she erroneously categorised him as an employee without providing an SDS or communicating her decision to Harvey or his agency.

By overlooking crucial principles in Harvey’s assessment, Alice misclassified him as an employee despite HMRC guidance suggesting otherwise. Consequently, Alice and the company face penalties and interest charges due to non-compliance with IR35 regulations.

In the first scenario, Alice’s proactive approach ensured compliance by providing Harvey and his agency with a detailed SDS.

What is a Status Determination Statement (SDS) for IR35?

An SDS is a statement issued by your business that determines a worker’s employment status following an IR35 assessment. It is imperative that the SDS provides a clear rationale behind the determined status. Utilising the Check Employment Status for Tax tool can assist in accurately identifying whether a worker should be classified as an employee or a contractor according to the off-payroll working rules.

This tool serves as a valuable resource for businesses across the UK, aiding them in maintaining compliance and demonstrating that they have taken reasonable care in assessing the status of their workers. Additionally, it is important to note that until the worker is notified of your status decision and the reasoning behind it, it remains your company’s responsibility to deduct income tax and national insurance contributions.

Employee vs. Independent Contractor Classification: Factors for Businesses to Consider

In light of IR35 case law, a series of employment tests has been established to aid employers in classifying all workers under their supervision. These assessment criteria encompass:

- Control

- Substitution

- Mutuality of obligation

- Miscellaneous factors

It is essential to assess these tests collectively to obtain the most accurate understanding of an individual’s employment status, as relying solely on a single factor may lead to misinterpretation.

Employers should bear in mind that HMRC evaluates these factors not solely based on the written contract but also on actual working practices. Thus, “implied” terms can take precedence over the written terms of a contract if inconsistencies exist between the two. While control, substitution, and mutuality of obligation are primary considerations in determining employment classification, they may not always provide a comprehensive depiction of the situation.

Additional factors to contemplate include:

- The nature of the contract

- Payment structure

- Level of financial risk assumed

- Provision of necessary equipment to fulfill responsibilities

Each of these factors possesses the potential to differentiate between an inside IR35 contract and an outside one.

0 Comments