FRC Enhances UK and Ireland Accounting Standards

- Posted by kalyani

- On April 10, 2024

- 0 Comments

On March 27, 2024, The Financial Reporting Council (FRC) issued amendments to FRS 102, The Financial Reporting Standard applicable in the UK and Republic of Ireland, as part of the Periodic Review 2024. These amendments are scheduled to take effect for accounting periods beginning on or after January 1, 2026, with early adoption permitted. The proposed revisions aim to enhance consistency and alignment with international accounting standards, including:

- Introducing a new revenue recognition model, in line with IFRS 15: Revenue from Contracts with Customers, albeit with some simplifications.

- Implementing on-balance sheet lease accounting for lessees, aligned with IFRS 16: Leases, while also incorporating practical exemptions.

- Making other adjustments related to fair value measurement, uncertain tax positions, business combinations, and a revised Section 2 aligned with the IASB’s Conceptual Framework.

The amendments aim to elevate the quality of UK financial reporting and facilitate access to capital, fostering growth for the estimated 3.4 million businesses impacted by these standards.

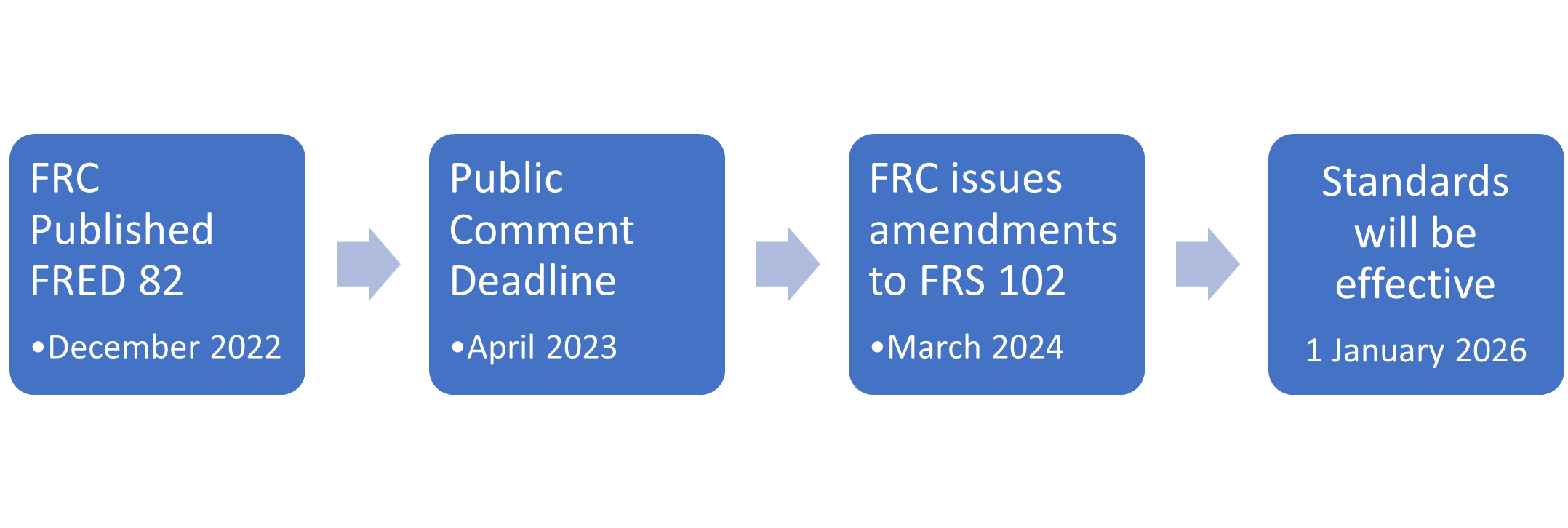

Illustration 1: Infographic: Timeline of FRC’s amendments

Key Changes and Objectives

The revisions primarily target leases and revenue recognition, aligning with recent adjustments to international financial reporting standards. These changes aim to furnish stakeholders, including investors and lenders, with improved financial information. Noteworthy modifications include enhancements to lease accounting and a revised recognition exemption for leases of low-value assets, emphasizing the importance of recognizing significant leases on balance sheets.

Simplification and Clarity

In response to stakeholder feedback, the FRC has introduced several improvements and clarifications to enhance the applicability and comprehension of the standards. These refinements are anticipated to streamline reporting processes for preparers, ultimately resulting in higher-quality and more easily understood financial reports.

Balanced Approach

While acknowledging the implementation costs associated with these changes, the FRC has strived to ensure proportionate adjustments and alleviate unnecessary reporting burdens. Stakeholder engagement has been instrumental in garnering support for the updates, particularly the revenue recognition accounting model.

Outlook and Implementation

The amended standards are slated to take effect for accounting periods beginning on or after 1 January 2026. Throughout 2024, the FRC plans to release new editions of the standards and updated guidance materials to assist preparers in navigating the new requirements. Additionally, a webinar discussing the revised standards is scheduled for 15 May 2024.

Conclusion

The FRC’s revisions to UK and Ireland accounting standards signify a commitment to fostering transparency, comparability, and accessibility in financial reporting. By striking a balance between regulatory rigor and operational feasibility, these changes are poised to bolster the financial landscape, empowering businesses to pursue growth opportunities with confidence.

0 Comments