Financial Planning for Start-Ups in the UK

- Posted by admin

- On April 7, 2025

- 0 Comments

- Business growth strategy, Fundraising valuation, IPO preparation, Startup valuation

Introduction

In the dynamic and rapidly changing business landscape of United Kingdom, startups encounter the formidable challenge of establishing their presence amidst fierce competition and unpredictable economic circumstances. Among the myriad factors influencing their success, effective financial planning emerges as a pivotal element. Central to this planning is the ability to forecast financial outcomes with precision. This article endeavors to offer a comprehensive examination of the significance of financial forecasting for startups, elucidating its critical role, the essential components comprising a startup’s financial plan, methods for refining forecasting accuracy, tactics for surmounting typical obstacles, and guidance on executing financial plans adeptly.

Comprehending Financial Planning for Startups

Financial planning for startups resembles plotting the course for a ship’s voyage. Without it, navigating the turbulent waters of the business realm becomes not only arduous but also fraught with risks. This undertaking entails delineating financial objectives, devising strategies to attain them, and establishing the framework for adeptly managing financial resources. For startups in UK, financial planning proves indispensable, not only for securing initial funding but also for sustaining operations, fostering growth, and ultimately ensuring long-term viability. It encompasses a spectrum of activities ranging from budgeting and cash flow oversight to investment strategising and risk evaluation.

The significance of financial planning cannot be overstated. It empowers startups to identify potential financial obstacles early on, enabling timely adjustments to business strategies. Moreover, a meticulously crafted financial plan serves as a compelling dossier when engaging with prospective investors, creditors, and stakeholders. It furnishes them with insights into the business’s vision, financial well-being, and growth trajectory. Additionally, financial planning streamlines resource allocation, ensuring prudent expenditure to advance business objectives.

However, the linchpin of effective financial planning lies in precise financial forecasting. The capacity to anticipate future financial outcomes not only shapes a startup’s financial strategy but also bolsters its resilience amidst market fluctuations and economic upheavals. This underscores the criticality of grasping the intricacies of financial forecasting and seamlessly integrating it into the financial planning framework.

The Significance of Financial Forecasting

Financial forecasting entails estimating a company’s forthcoming financial performance by analysing historical data, prevailing market trends, and anticipated events. In the context of startups in UK, where economic fluctuations and shifts in consumer behavior wield substantial influence over business operations, the significance of financial forecasting cannot be overstated. It serves multifaceted purposes, from facilitating efficient cash flow management to guiding strategic decisions concerning investments and expansions.

Primarily, financial forecasting provides a glimpse into the future, equipping startups with the ability to project revenues, expenditures, and profitability. This foresight proves invaluable for establishing realistic financial goals and benchmarks, thereby guiding the strategic planning and operational endeavors of the business. Furthermore, it assumes a pivotal role in risk mitigation. By preemptively identifying potential financial shortfalls and market challenges, startups can formulate contingency plans to effectively mitigate risks.

Moreover, financial forecasting is indispensable for attracting and securing funding. Investors and financial institutions seek a transparent outlook on a startup’s financial trajectory before committing their resources. A robust financial forecast not only showcases the potential for profitability but also underscores the startup’s dedication to fiscal prudence and strategic foresight.

Key Components of Financial Planning:

A startup’s financial plan serves as a comprehensive blueprint outlining its financial strategy and projections. It comprises several key components, including:

- Revenue Forecast: This segment predicts the sales anticipated by the startup over a specified period. It considers factors such as market size, pricing strategy, and sales channels to provide an estimate of future revenue streams.

- Expense Budget: In this section, startups enumerate all projected operating costs, encompassing both fixed expenses (e.g., rent, salaries) and variable expenses (e.g., marketing, production costs). By delineating expenses, the plan offers a clear depiction of the financial resources required to sustain the business.

- Cash Flow Statement: This component furnishes a detailed breakdown of the cash inflows and outflows experienced by the startup, elucidating its liquidity position. It is instrumental in ensuring that the business maintains adequate cash reserves to fulfill its financial obligations.

- Profit and Loss Statement (P&L): Also referred to as an income statement, the P&L furnishes an overview of the startup’s profitability. It delineates revenues, costs, and expenses incurred over a specific timeframe, providing insights into the company’s financial performance.

- Balance Sheet: Serving as a snapshot of the startup’s financial health at a particular juncture, the balance sheet outlines its assets, liabilities, and equity. It offers valuable insights into the company’s solvency and capital structure, aiding stakeholders in assessing its financial viability.

Important Considerations for Start-ups for Financial Planning

- Tax Management

Effective tax management is fundamental to the financial planning of startups and small businesses. Given the intricacies of the UK tax system, overlooking or misinterpreting tax obligations can result in significant financial setbacks. A robust financial plan serves as a guiding framework, enabling businesses to anticipate their tax liabilities, allocate funds accordingly, and meet filing deadlines accurately.

By proactively addressing tax obligations, startups can steer clear of penalties, uphold financial stability, and make informed decisions aligned with their tax strategy. Whether it pertains to corporate tax, personal income tax, or other levies, a well-structured financial plan provides a roadmap for navigating the complexities of the tax landscape.

- VAT Registration

For startups and small businesses in the UK, Value Added Tax (VAT) registration is a pivotal consideration. Monitoring turnover against the VAT registration threshold marks a crucial financial milestone. A meticulously crafted financial plan with forward-thinking capabilities enables businesses to track their turnover meticulously and strategically plan for VAT registration as they approach the threshold.

By adopting a proactive stance towards VAT registration, businesses can sidestep unnecessary complexities, ensure compliance with HM Revenue and Customs (HMRC) regulations, and streamline their financial operations. Financial planning serves as a preemptive measure, facilitating seamless navigation of VAT responsibilities.

- Budgeting and Cash Flow Management

Effective financial planning goes hand in hand with prudent budgeting and astute cash flow management. For startups and small businesses, where resource optimisation is paramount, a well-defined budget acts as a roadmap for allocating resources judiciously. It facilitates the identification of cost-saving opportunities, prioritisation of expenditures, and contingency planning.

Furthermore, adept cash flow management is indispensable for sustaining day-to-day business operations. By forecasting cash requirements and anticipating potential shortfalls, businesses can preemptively address financial challenges, negotiate favourable terms with suppliers, and uphold a robust financial standing.

- Funding and Investment Decisions

Startups often rely on external funding to fuel their growth trajectory. Financial planning assumes a pivotal role in attracting investors and making informed investment decisions. By presenting a transparent financial outlook, businesses can instill confidence in potential investors, secure funding, and strategise resource allocation effectively.

A comprehensive financial plan also facilitates the evaluation of the return on investment (ROI) for various initiatives, enabling businesses to prioritise projects aligned with their growth objectives. This strategic approach to funding and investment positions startups for sustainable growth and success.

- Risk Mitigation

In an inherently uncertain business landscape, risk mitigation is imperative. Financial planning empowers startups and small businesses to identify potential risks, assess their implications, and devise mitigation strategies. Whether it pertains to market fluctuations, supply chain disruptions, or unforeseen expenses, a robust financial plan serves as a buffer against unforeseen challenges.

By anticipating and planning for risks, businesses can navigate uncertainties with resilience and agility. This proactive approach to risk management is particularly vital for startups seeking to establish themselves in competitive markets.

- Long-Term Sustainability

Financial planning extends beyond short-term objectives; it lays the groundwork for long-term sustainability and growth. Startups and small businesses that prioritise financial planning set themselves up for enduring success. A strategic financial plan aligns with the business vision, guiding it through the ebbs and flows of the market and ensuring steadfast progress towards long-term goals.

How to prepare for Financial Planning?

Budgeting and Forecasting

- Start by creating a detailed budget outlining projected revenues and expenses.

- Utilise financial forecasting techniques to anticipate future cash flows and identify potential challenges.

- Regularly review and adjust the budget based on actual performance to maintain financial stability.

Cash Flow Management

- Maintain a robust cash flow management system to monitor incoming and outgoing funds.

- Implement strategies to optimise cash flow, such as minimising inventory costs and extending payment terms with suppliers.

- Anticipate cash flow gaps and establish contingency plans to address short-term liquidity challenges.

Funding Strategies

- Explore various funding options available to start-ups, including bootstrapping, equity financing, and debt financing.

- Assess the pros and cons of each funding source and choose the most suitable option based on the business’s growth stage and financial needs.

- Build relationships with investors and financial institutions to secure funding and support future growth initiatives.

Financial Risk Management

- Identify potential financial risks that could impact the business, such as market volatility, regulatory changes, and economic downturns.

- Develop risk mitigation strategies to minimise exposure and protect the business from unforeseen circumstances.

- Consider obtaining appropriate insurance coverage to safeguard against financial losses due to events like property damage or legal liabilities.

Tax Planning and Compliance

- Stay informed about tax laws and regulations applicable to start-ups in the UK, including corporate tax, VAT, and employee taxes.

- Work with qualified tax professionals to optimise tax planning strategies and ensure compliance with regulatory requirements.

- Take advantage of available tax incentives and reliefs, such as research and development (R&D) tax credits, to reduce tax liabilities and reinvest savings into business growth.

Financial Reporting and Analysis

- Implement robust accounting systems to track financial transactions and generate accurate financial reports.

- Conduct regular financial analysis to evaluate performance indicators, assess profitability, and identify areas for improvement.

- Use financial data to make informed business decisions and adjust strategies to achieve desired outcomes.

Enhancing the Accuracy of Financial Forecasting

Attaining precision in financial forecasting poses a formidable challenge, particularly for startups navigating volatile markets. Nonetheless, adopting specific techniques can markedly improve the reliability of these forecasts:

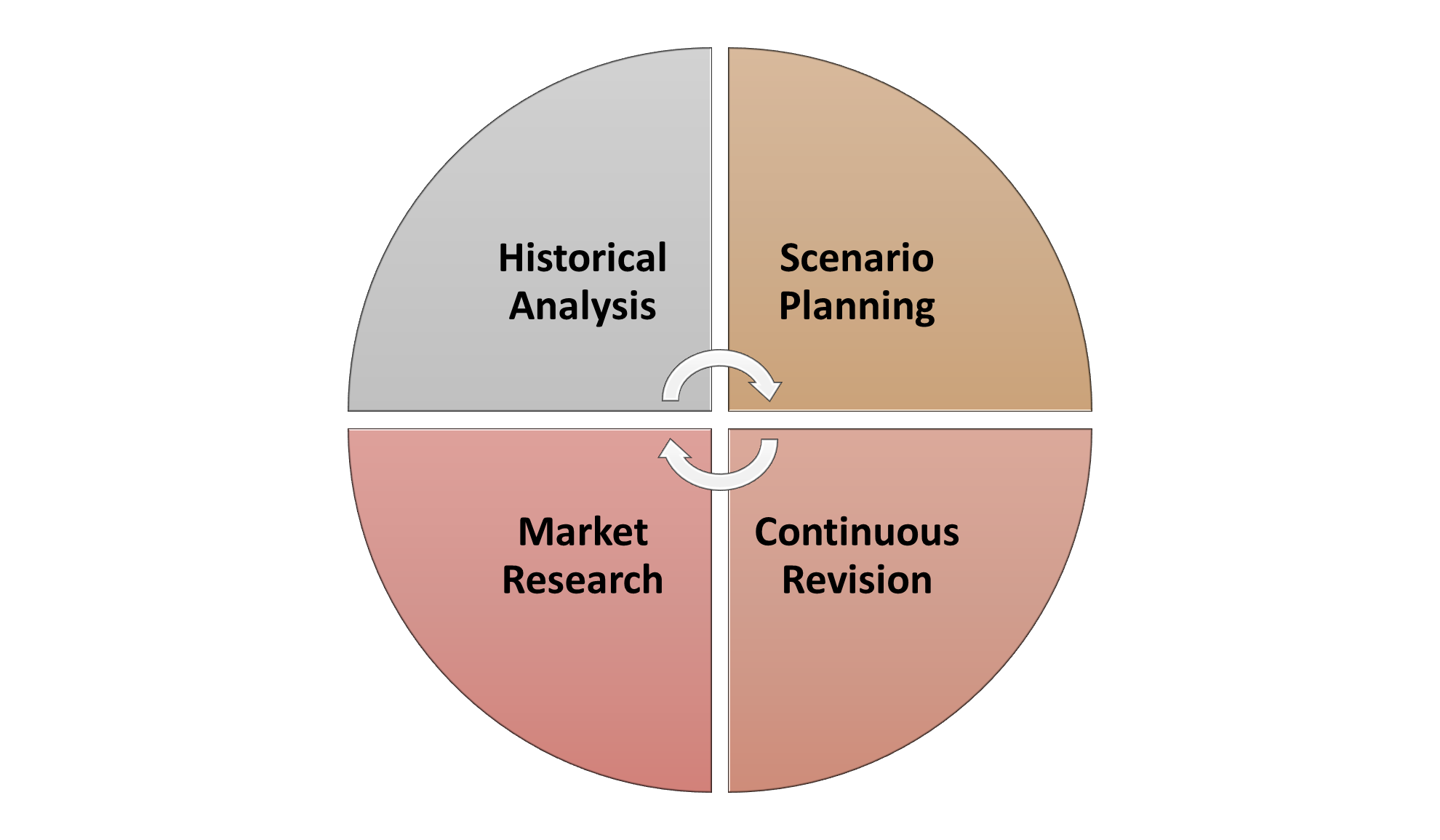

Illustration: Infographic: Techniques to improve reliability of forecasts

- Historical Analysis: Harnessing historical financial data enables startups to discern trends and patterns, laying a robust groundwork for future projections. By analysing past performance, including revenue streams, expense trends, and market fluctuations, startups can derive valuable insights to inform future forecasts.

- Scenario Planning: Crafting multiple forecasts predicated on diverse scenarios—optimistic, pessimistic, and most likely—equips startups with a comprehensive understanding of potential outcomes. By envisioning various scenarios and their associated impacts on financial performance, startups can devise contingency plans and mitigate risks more effectively.

- Market Research: Vigilantly monitoring market trends, industry reports, and competitor analysis furnishes startups with invaluable data to inform their forecasts. By staying abreast of evolving market dynamics and consumer preferences, startups can refine their projections to align more closely with prevailing market conditions, enhancing forecast accuracy.

- Continuous Revision: Financial forecasts should not be static documents but dynamic tools that evolve in tandem with changing circumstances. Regularly revising forecasts based on actual business performance and evolving market dynamics ensures their relevance and accuracy. By incorporating real-time data and insights, startups can refine their forecasts iteratively, thereby enhancing their predictive capabilities.

By leveraging these techniques in tandem, startups can bolster the accuracy and reliability of their financial forecasts, empowering them to make informed strategic decisions and navigate uncertainties with confidence.

Tackling Common Forecasting Hurdles

Financial forecasting poses unique challenges for startups, stemming from factors like scant historical data, volatile market dynamics, and fluctuating costs. Overcoming these hurdles demands a combination of ingenuity, practicality, and forward-thinking. To illustrate, startups can supplement sparse internal data with industry benchmarks and competitor insights to enrich their forecasts. Moreover, adopting a flexible approach and incorporating contingency plans into forecasts can mitigate the inherent unpredictability of startup ventures.

Conclusion

Financial planning is a fundamental aspect of building a successful start-up in the UK. By prioritising financial planning from the outset, entrepreneurs can effectively manage resources, minimise risks, and drive sustainable growth. Whether it’s budgeting and forecasting, cash flow management, funding strategies, or tax planning, every aspect of financial planning plays a crucial role in shaping the financial health and resilience of a start-up. By embracing a proactive approach to financial planning and seeking professional guidance when needed, start-ups can navigate the complexities of the financial landscape with confidence and chart a path to long-term success.

0 Comments