ESG-oriented Organizations: Risks to Stakeholders

- Posted by kalyani

- On February 8, 2024

- 0 Comments

As climate action continues to be a focal point, ESG investing strategy has soared to become the most popular investment strategy for investors of all types. As we project into 2024, global investments in ESG are likely to surpass US$53 trillion by 2025 on the back of growing investor demand.

Sustainability-focused organizations tend to be more efficient, save money, have lower employee turnover, are innovative, retain talent, reduce compliance costs, and manage risk better – all of which may contribute to rise in shareholder value.

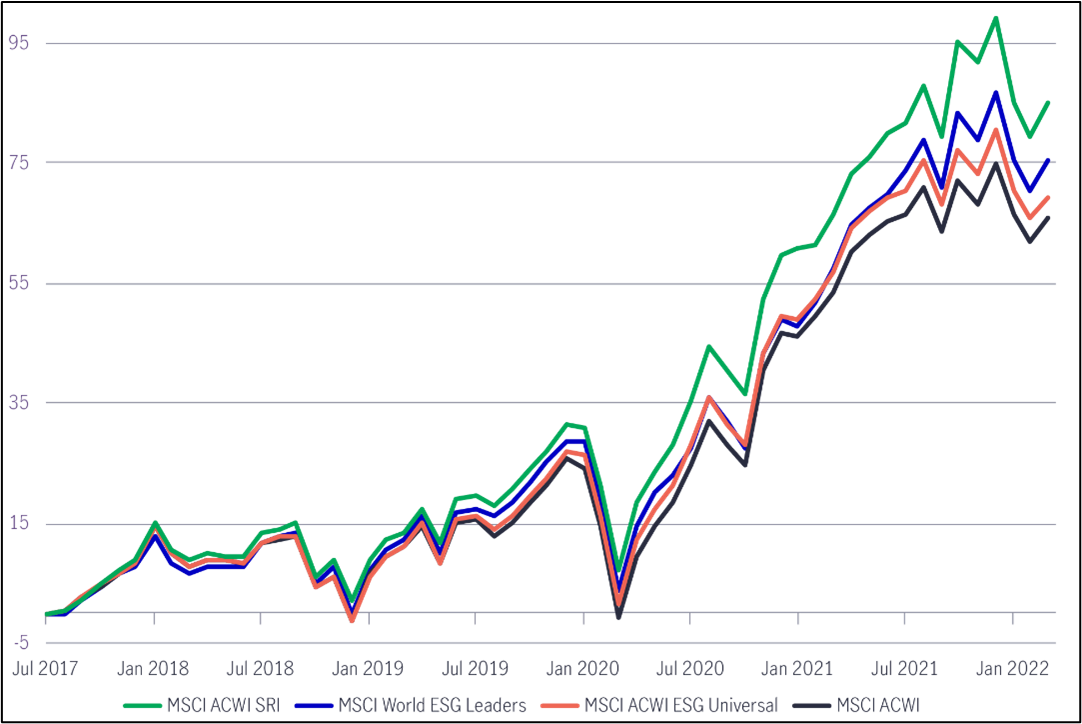

Illustration 1: Chart – Index performance of select MSCI ESG Indexes and MSCI All Country World Index (ACWI)

Source – https://www.manulifeim.com.ph/insights/5-benefits-of-esg-investing.html

ESG Scenario in US

Looking ahead to 2024, the Environmental, Social, and Governance (ESG) landscape in the United States is marked by several noteworthy trends and expectations. ESG considerations are increasingly becoming intrinsic to corporate strategies, with data indicating that companies with strong ESG performance outperformed their counterparts during recent market volatility. Investment decisions are witnessing a paradigm shift, as evidenced by the fact that ESG funds attracted record-breaking inflows in 2023, surpassing previous records.

Technological advancements, including AI-driven ESG analytics, are on the rise, offering more sophisticated data-driven insights. Diversity and inclusion metrics are gaining prominence, supported by studies revealing that diverse companies are more likely to outperform their peers. Climate change action is a focal point, with data showing a surge in companies pledging to achieve net-zero emissions by 2025.

Supply chain sustainability is gaining traction, with consumer surveys indicating a growing preference for eco-friendly and ethically sourced products. The prevalence of green bonds is indicative of the expanding green finance market. As government initiatives gain momentum, data highlights a correlation between strong ESG performance and eligibility for certain incentives. ESG reporting standardization efforts are evident in the rise of organizations adopting frameworks like SASB and TCFD.

Crisis preparedness is underscored by statistics showcasing the financial impact of ESG-related crises on companies. This multifaceted outlook for 2024 reflects a data-driven transformation, affirming the integral role of ESG considerations in shaping the future of businesses in the United States.

ESG Scenario in UK

The ESG growth in the United Kingdom is marked by robust growth and evolving trends, supported by notable data and statistics. The UK government’s commitment to achieving net-zero emissions by 2050 is a cornerstone, driving increased focus on sustainability across industries. Regulatory frameworks are set to progress further, aligning with global ESG standards, and data indicates a surge in companies disclosing their environmental impact, with a 33% increase in ESG-related disclosures reported in the past year.

The revised UK Stewardship Code, anticipated in 2023, is expected to elevate institutional investors’ engagement on ESG issues, as seen in the 2023 UK Stewardship Code’s emphasis on climate considerations. Investors are actively incorporating ESG factors into their decisions, with sustainable funds in the UK reaching record-breaking assets under management (AUM) of £43.4 billion in 2023. The UK’s Green Finance Institute is playing a pivotal role in driving sustainable finance, with a 37% increase in green bond issuance in 2023. Social considerations, including diversity and inclusion, are gaining prominence, supported by data revealing a positive correlation between diverse boards and financial outperformance.

As companies increasingly integrate ESG metrics into executive pay structures, data underscores a growing trend in linking executive remuneration to sustainability targets. The financial industry, with a 64% increase in sustainable investments in 2023, is a key driver of the ESG agenda. With these trends and data points, the ESG outlook for the UK in 2024 is characterized by a robust, data-informed trajectory towards sustainability and responsible business practices.

Identifying ESG Fraud Risks

Investing, lending, and evaluating the key risks of ESG organizations is crucial to safeguard financial and reputational damages. These risks comprise but are not limited to:

Fraudulent Transfers, Misuses, and Abuses of Funds & Credits

- There is a risk of green funds being used for unauthorized/ineligible projects in violation of the ESG initiative’s stated purpose and intent.

- Funds are transferred to subsidiaries, group companies, or other corporates for purposes unrelated to ESG without the investors’ or lenders’ permission.

- In some cases, the purpose of applying for funds for connected/related organizations may not be related to ESG issues, such as pledging shares or other assets of ESG organizations.

Environmental Risks

- Greenwashing: False or misleading claims about the sustainability and environmental practices of an organization, such as false advertising, misleading recycling claims, false claims regarding low emissions, and unsupported carbon footprint claims.

- Bluewashing: UN Global Compact (UNGC) registration advertising without adhering to UNGC principles.

- Consciously undermining environmental monitoring systems, including air, air quality, and water quality monitoring.

- Inadequate waste disposal and failure to separate recyclables & non-recyclables.

- Monitoring environmental impacts ineffectively or without periodic assessments.

Social Risks

- Inadequate industrial safety standards for worker protection and non-compliant working conditions.

- Savings and deposit programs that force workers to withhold a portion of their wages, creating a sense of servitude.

- A lack of health and safety management systems for employees and inadequate insurance policies.

- Purplewashing/Pinkwashing: Organizations that intentionally attempt to emphasize the diversity of women/LGBTQ communities in order to distract from contradictory internal practices, such as significant gender pay gaps, discrimination in appraisals, and inadequate prevention mechanisms for sexual harassment.

- Brownwashing: Publicly portraying support for communities, regardless of their caste, creed, and race, but failing to support their own employees on these factors.

Governance Risks

- Obtaining fraudulent licenses/permits or overlooking non-compliances during inspections through facilitation payments and bribery.

- Deficiencies in data security and cybercrime controls, which could lead to loss of sensitive and confidential data of employees, customers, vendors, and others.

- Non-compliance with regulatory requirements such as financial statement fraud, tax evasion, insider trading, and stock price manipulation.

- Initiatives, programs, and metrics related to ESG disclosures and regulatory reporting.

- Inadequate management oversight and weak internal control mechanisms resulting in significant instances of fraud/unethical behavior among employees, vendors and other third parties associated with the organization.

How Can Such Risks be Mitigated?

Prior to investing or lending in ESG organizations, investors, lenders, and board members should adequately assess the risks and monitor them periodically. Following are some potential steps that the organizations may take:

Due Diligence Prior to Investment

- Assess if there is any adverse information about the company’s promoters, shareholders, or lenders.

- Verify the authenticity of ESG-related activities and claims made in ESG reporting metrics.

- Evaluate the effectiveness of the ESG framework, internal control systems, anti-bribery and corruption framework, key policies/procedures, and other governance mechanisms in place in the ESG organization.

- Examine the adequacy and genuineness of the supporting documents of the ESG organization and determine the veracity and authenticity of the revenues and expenses.

Reviewing and Monitoring Post-investment

- Reviewing ESG frameworks, policies, procedures, and monitoring mechanisms periodically in order to assess their adequacy and compliance with ESG requirements.

- Identifying red flags of malpractice, corruption, or bribery in the ESG organization through periodic diagnostic reviews.

- Assessing the effectiveness of ESG frameworks, policies, procedures, monitoring mechanisms, and regulatory reporting.

- Impart training and create awareness among employees and third parties associated with the ESG organization to build a robust ESG framework.

The Gist

There is a well-anticipated robust surge in the global emphasis on ESG in the coming years, which will also drive ESG-oriented investing and lending. Subsequently, as regulations and laws regarding ESG compliance and reporting mechanisms evolve, they are likely to become more stringent. Proactive actions in this scenario are a requisite to safeguard the ESG organizations, their board of directors, investors, and lenders from any regulatory penalties, unforeseen litigation, and financial or reputational damage arising from any ESG-related issue.

0 Comments