ESG Impact on Valuation

- Posted by kalyani

- On February 26, 2024

- 0 Comments

The environmental, social, and governance (ESG) factors are now central to both the provision and use of capital (e.g., investors and corporations). In order to improve returns, institutional investors leverage ESG filters. In addition, C-Suite management has begun incorporating ESG into their capital budgeting processes to demonstrate their commitment to sustainability.

There are two factors that explain the meteoric rise of ESG in capital allocation processes, one arising from the unprecedented yesteryears, the other arising from the many environmental, social and governance factors that are now being considered as part of the capital allocation process. Valuers are well aware that a decline in interest rates increases future benefits’ present value. A decrease in interest rates will have a greater relative impact on present value when the benefit is further in the future. Due to the fact that a greater percentage of the present value of cash flows is now anticipated in the distant future, the ESG framework has become more critical.

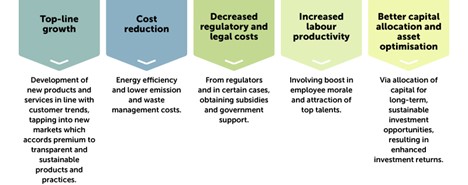

Illustration 1- Infographic- ESG as Drivers of Business Value

ESG therefore represents a set of qualitative, non-financial, and interconnected factors used by the markets to assess a company’s impact and sustainability. The following five ways in which good ESG practices affect economic performance and valuation have been identified based on various publicly available sources:

Source: https://www.at-mia.my/2022/06/24/considering-esg-in-business-valuation/

Key Affecting ESG Factors

Here are some key aspects in which ESG factors can impact the valuation of a company:

Top-line Growth

Developing sustainable products that align with consumer requirements can have a positive impact on a business’s top-line growth, especially when considering ESG factors. This approach involves meeting consumer demand for eco-friendly and socially responsible products, which can lead to increased sales, customer loyalty, and enhanced market positioning. Here’s how ESG principles and the development of sustainable products can contribute to top-line growth:

Consumer Demand and Preference:

Environmental Concerns: Consumers increasingly seek products that have a lower environmental impact, such as those with reduced carbon emissions, sustainable sourcing, or minimal waste.

Social Responsibility: Consumers are attracted to products that are produced under fair labor conditions and contribute positively to communities. This aligns with ESG’s social factors.

Innovation and Competitive Advantage:

Market Differentiation: Sustainable products can set a business apart from competitors by addressing environmental and social challenges in unique and innovative ways.

Early Adopter Advantage: Businesses that pioneer sustainable solutions may capture a first-mover advantage, gaining loyal customers who appreciate their commitment to ESG.

Brand Image and Loyalty:

Brand Reputation: Developing sustainable products demonstrates a company’s commitment to responsible practices, enhancing its reputation and attracting customers who value such initiatives.

Customer Loyalty: Consumers who resonate with a brand’s sustainable values are more likely to become repeat customers, contributing to steady revenue growth.

Market Expansion:

Growing Market Segments: The market for sustainable products is expanding as consumer awareness increases. Offering products that cater to this segment can open up new revenue streams.

Geographical Opportunities: Sustainable products can resonate with diverse audiences globally, allowing businesses to tap into new markets.

Risk Mitigation:

Environmental and Regulatory Risks: Developing sustainable products can mitigate risks associated with changing regulations and consumer preferences, ensuring continuity of revenue streams.

Reputation Management: Avoiding negative environmental or social impacts linked to products can protect a business’s reputation and maintain consumer trust.

Innovation Ecosystems:

Partnerships: Collaborating with suppliers, partners, and startups in sustainability-focused ecosystems can lead to novel ideas, technologies, and product concepts that drive growth.

Product Longevity and Futureproofing:

Long-Term Viability: Sustainable products often have longer life cycles and greater resilience, ensuring sustained revenue even as market dynamics evolve.

Anticipating Trends: ESG trends are likely to continue influencing consumer preferences. Businesses that develop sustainable products can align with future market demands.

Cost Reduction:

ESG initiatives often give rise to cost reductions and improved operational efficiency. For example, energy-efficient practices can lower operational costs, waste reduction can lead to cost savings, and employee well-being initiatives can enhance productivity. These improvements in financial performance can positively impact a company’s valuation.

Decreased Regulatory and Legal Costs:

Companies that prioritize ESG considerations are better positioned to comply with evolving environmental and social regulations. Compliance with ESG regulations can prevent legal risks and potential liabilities, leading to a more stable and valuable business.

Investor Demand and Market Sentiment:

Investor demand for ESG investments is on the rise, and companies with robust ESG practices may experience higher demand for their shares. Positive market sentiment towards sustainable and responsible companies can lead to higher stock prices and valuation multiples.

Increased Labor Productivity:

Companies that prioritize ESG factors tend to attract and retain top talent. Employees increasingly seek employers with strong ethical values and social responsibility commitments. A skilled and engaged workforce can contribute to a company’s long-term success and valuation.

Better Capital Allocation and Cost optimisation:

Investors are increasingly considering ESG factors when making investment decisions. Companies with strong ESG performance may have better access to capital and can attract sustainable and socially responsible investors. Additionally, lower perceived risk due to strong ESG practices can lead to a reduction in the cost of capital for these companies.

Incorporating ESG Framework into Business Valuation

Despite the importance of ESG to businesses, progress in developing globally accepted standards for integrating ESG considerations into valuations is still in its infancy. International Valuation Standards Council (“IVSC”) states that there is a common misconception that ESG disclosures are non-financial by nature, and therefore, have no financial impact. It ignores the fact that ESG encompasses a wide range of factors that determine an organization’s long-term viability and sustainability. In assessing these factors, we must move away from the conventional “price x quantity” analysis and examine how they enable enterprises to create value over the long-term. According to the report, ESG factors should be embedded into current valuation procedures and methods. We explore the benefits and challenges presented by IVSC while offering our views on each.

The Market Approach –According to the market approach, the following should be taken into account when valuing ESG considerations:

- Analyze and compare ESG practices among comparable companies and industries.

- Using such criteria, evaluate the performance of the subject company.

- Using comparable companies’ performance as a comparison, calibrate the market inputs to the subject entity.

The primary disadvantage of this approach is that ESG data, disclosures, and rating systems are still in their infancy. Therefore, a company’s ESG factors and practices would be scored based on judgment, with different practitioners possibly assigning different weightings/scorings.

The Income Approach – The income approach should incorporate ESG considerations into its discount rate or cash flow valuation. IVSC recommended avoiding double counting certain ESG factors implicitly incorporated in valuations.

Beta – It involves screening and analyzing comparable companies and incorporating into the screening process ESG considerations applicable to the subject entity’s industry.

Alpha – This indicates an incremental adjustment to the discount rate, on top of beta. Accordingly, an organization whose ESG practices are poor when compared to its competitors would be granted a higher discount rate.

Source: https://www.roedl.com/insights/ma-dialog/2023-03/impact-esg-factors-business-valuation

In view of the limited research and data available in this context, determining the magnitude of adjustment would be a challenge. When determining alpha, it is also important to avoid double counting the risk stemming from poor ESG practices, which have already been taken into account by the market.

Even though there is inherent subjectivity involved, there is encouraging evidence that high-ESG-rated companies have lower capital costs.

As part of a Discounted Cash Flow (DCF) or income approach, the valuation specialist should assess whether the company’s business plan already takes into account the ESG risks and opportunities, and to what extent. As an example, a decrease in sales revenue due to poor reputation, an increase in taxes due to legal requirements, or an increase in CAPEX to reduce ESG risks could be considered.

It is also possible to add risk premiums to the discount rate. The first step is to identify the drivers of the business model as well as their associated risks. The ESG risk factor implies that returns may fluctuate due to opportunities and risks related to ESG factors. A poor ESG score, for example, can be correlated with a higher risk profile, which in turn leads to a lower DCF enterprise value.

The consideration of ESG factors can, however, also be integrated into market-oriented valuation approaches (e.g., multiple analysis). In a multiples analysis, ESG criteria for the respective industry should be identified and assessed first, then compared with the target company’s ESG performance. Accordingly, the valuation parameters (for example, market multiples) are adjusted to the target company to take into account the company’s relative performance versus its peers. Due to the fact that this process deviates marginally from traditional multiple valuation, it is easy to integrate it into the business valuation process.

Conclusion

ESG factors are increasingly integrated into the valuation of companies as investors and stakeholders recognize their impact on long-term sustainability and performance. A strong ESG performance can lead to enhanced reputation, access to capital, customer loyalty, and talent attraction, all of which contribute to a higher valuation. Companies that prioritize ESG considerations and integrate them into their core business strategies are more likely to create value for all stakeholders, positioning themselves for long-term success in an evolving business landscape. As a result, ESG factors have become a critical aspect of company valuation in today’s investment landscape.

However, it will take continuous effort to achieve consensus on the standardised approach for incorporating ESG into valuation. In order to achieve this, regulations are rapidly evolving towards a more homogenized ESG measurement and reporting framework, which will aid practitioners in better capturing and quantifying ESG considerations in valuations.

0 Comments