Enhancing Audit Quality in Tier 2 and Tier 3 Firms: A Comprehensive Approach Suggested by UK FRC

- Posted by kalyani

- On April 16, 2024

- 0 Comments

In the world of auditing, the quality of audits is paramount. The UK Financial Reporting Council’s (FRC) latest review on Tier 2 and Tier 3 audit firms for 2022-23 brings to light significant insights. It underscores a pressing need for quality enhancement in these sectors.

Key Highlights

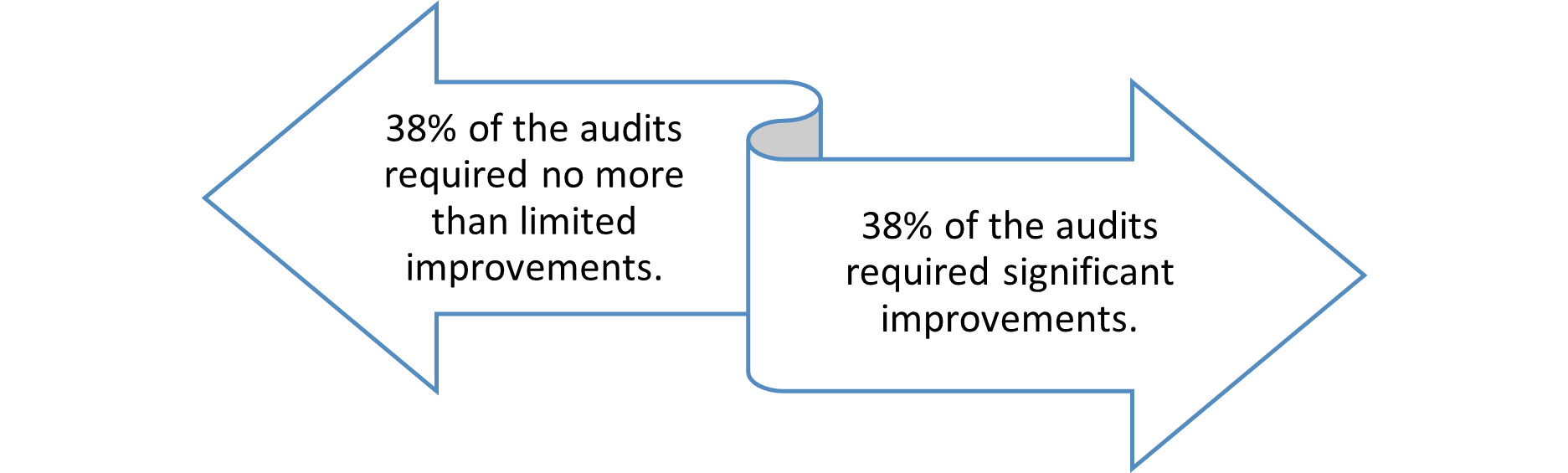

Tier 2 and Tier 3 firms, responsible for auditing 17% of UK Public Interest Entities (PIEs). But contribute less than 2% of the total PIE audit fees

This data paints a clear picture of the urgent need to enhance audit quality in these sectors.

Important Areas of Inspections and Observations

While most of the FRC’s findings reveal persistent issues in routine areas such as the audit of journal entries; compliance with archiving requirements and deficiencies in auditing judgments and estimates are particularly notable. There are also findings in complex audit areas that highlight a critical need for firms to adopt a more robust approach to complex audit areas, emphasizing the importance of professional skepticism.

| Area of Inspection | Observations | Strategies for Enhancing Audit Quality |

| Estimates and Judgments | Weakness in audit procedure performed to test methodology, assumptions, and data inputs. | Auditors in Tier 2 and Tier 3 firms must demonstrate enhanced professional skepticism, particularly in complex audit areas like the audit of estimates and judgments. |

| Going Concern | Insufficient procedures to test cash flow forecasts, evaluate the impact of breaches of loan covenants, and assess the refinancing of debts where it was the key assumption in the management’s going concern assessment. | Going concern assessment must be treated as critical, and firms must use their judgment and professional skepticism over management’s assessment and must challenge the same if not in agreement. |

| Journal Entry Testing | Weakness in the audit approach and the linkage of this to the audit team’s fraud risk assessment. | The audit approach and procedures must be robust and responsive to the fraud risk assessment and findings. |

| Quality Control Procedures | The inspection programme covered each area of the International Standard on Quality Control (UK) 1: leadership, compliance with ethical requirements, acceptance and continuous procedures, human resources, engagement performance and monitoring, and found shortcomings. | Firms must prioritize their investment in enhancing audit methodologies and quality management systems. This involves strengthening human resources and embedding a culture that values and prioritizes audit quality. |

The FRC’s Role in Driving Change

The FRC has stepped up its role in supervising and supporting these firms towards improvement. The introduction of the Audit Firm Scalebox is a commendable initiative, offering a resource for firms to understand and implement audit best practices. The FRC’s risk-based supervision, focusing on firms with significant shares in the UK PIE audit market, is instrumental in identifying and addressing deficiencies impacting audit quality.

KNAV’s Opinion

The FRC’s report serves as a crucial wake-up call for Tier 2 and Tier 3 audit firms. As the world of accounting and financial reporting continues to evolve, firms must embrace change, prioritize audit quality, and leverage the guidance and resources provided by regulatory bodies like the FRC. The path to enhancing audit quality is multifaceted, involving robust policies, investment in resources, adherence to regulatory changes, fostering a culture of quality and skepticism through continuous training, and leveraging technology. Engaging in peer reviews and seeking external consultations can provide fresh perspectives and insights into a firm’s audit methodologies and practices. By adopting these strategies, Tier 2 and Tier 3 firms can significantly improve their audit practices, contributing to the overall resilience and reliability of the financial auditing ecosystem. The dedication to excellence and perpetual improvement is more than a mere regulatory requirement; it constitutes a foundational element for upholding trust and integrity within the profession.

0 Comments