Bridging the UK Assurance Gap: Innovative Strategies for Expectation Alignment

- Posted by kalyani

- On December 12, 2023

- 0 Comments

- Rajesh Khairajani

Introduction

In the dynamic landscape of financial reporting and assurance in the United Kingdom, a significant challenge that persists is the expectation gap. This term refers to the difference between what the public and financial statement users expect from the audit process and what the audit profession actually delivers. This gap has profound implications not only for the credibility of financial statements but also for the trust placed in the auditing profession as a whole. As businesses evolve and stakeholder demands intensify, understanding and addressing this gap has never been more crucial.

Current Scenario

The UK’s assurance sector has undergone considerable changes, driven by technological advancements, evolving business models, and changing regulatory environments. Despite these developments, the expectation gap remains a persistent issue. Historically, this gap has widened during times of economic distress or corporate scandals, highlighting the disconnect between public expectations and the realities of audit practices.

Historical Evolution of the Expectation Gap

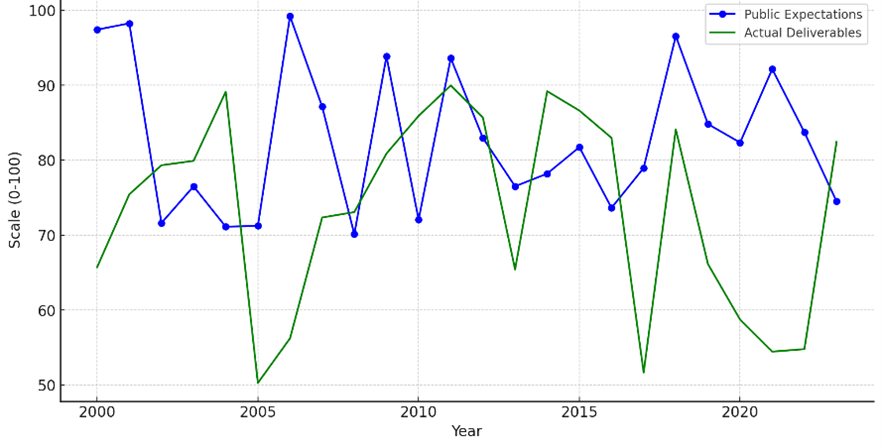

To understand the current state of the expectation gap, it’s essential to look at its historical evolution. Over the past two decades, the gap has fluctuated, often expanding in the wake of financial crises or corporate fraud cases.

Graph 1: The historical trend graph would illustrate these fluctuations, plotting public expectations against actual assurance deliverables from 2000 to 2023.

In this graph:

- The blue line with circle markers represents the public expectations.

- The green line with ‘x’ markers indicates the actual deliverables.

*Please note that the data used to create this graph is simulated and does not represent real-world statistics.

The Expectation Gap: A Closer Look

The expectation gap in assurance can be dissected into several components:

- Performance Gap: This is the difference between what the public expects in terms of audit quality and what auditors actually deliver.

- Reasonableness Gap: Often, there’s a mismatch between the public’s understanding of what auditors do and what auditors are professionally required to do. This gap stems from a lack of awareness about the limitations of an audit.

- Evolution Gap: As business practices evolve, there’s a lag in how audit practices adapt. This gap is about the pace of change in auditing standards and practices in response to changing business environments.

| Component | Public Perception | Professional Standards |

|---|---|---|

| Audit Scope | Audits should cover all aspects of a business, including future viability | Audits focus on the financial statements and material issues affecting them |

| Auditor Responsibilities | Auditors are responsible for detecting all types of fraud and errors | Primary responsibility is to detect material misstatements, not all fraud and errors |

| Financial Reporting | Auditors guarantee the absolute accuracy of financial statements | Auditors provide reasonable assurance, not an absolute guarantee |

| Risk Assessment | Auditors should predict and warn about future risks | Focus on assessing risks affecting financial statements, not predicting future risks |

| Fraud Detection | Auditors should identify and report all fraud cases | Responsibility to report detected fraud, not to find all possible fraud |

Table 1: differences in public perception versus professional standards would provide concrete data on these components.

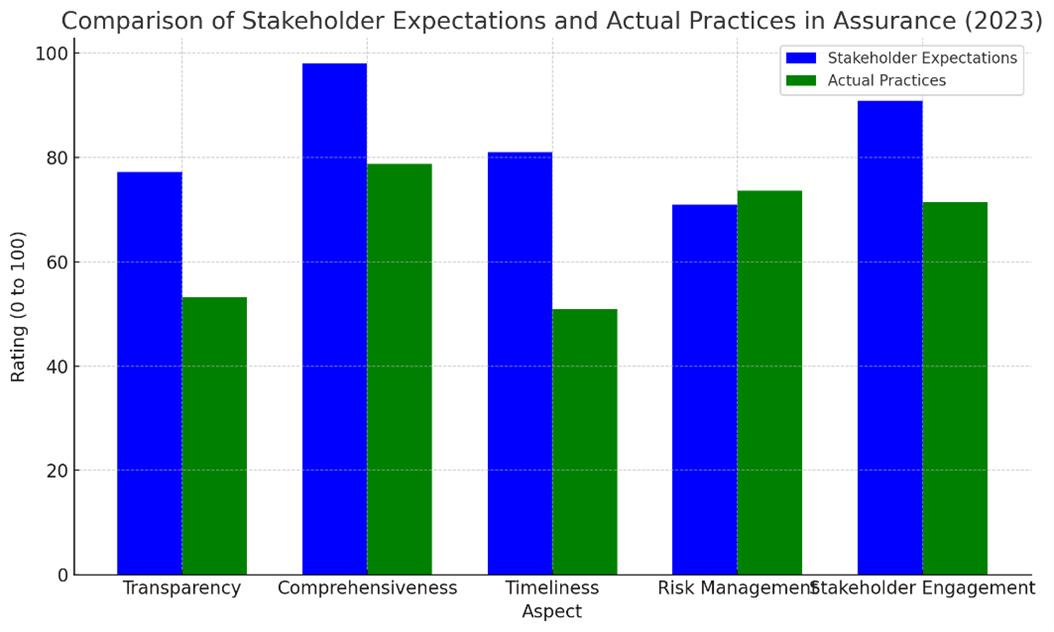

Insights from Data

Recent surveys and reports shed light on the depth and nature of the expectation gap in the UK. Stakeholders, including investors, regulators, and the general public, have varying expectations from assurance services, ranging from the scope of audits to the level of assurance provided on future viability.

Graph 2: This graph would compare stakeholder expectations with actual practices in the assurance sector in 2023, offering a visual representation of the current state of the expectation gap.

Bridging the Gap: Strategies and Solutions

Addressing the expectation gap requires a multifaceted approach:

| Proposed Regulatory Change | Potential Impact | Contribution to Bridging the Gap |

|---|---|---|

| Enhanced Disclosure Requirements | Improves transparency and trust in financial reporting | Addresses the performance gap by providing more comprehensive information |

| Mandatory Audit Firm Rotation | Reduces risk of auditor complacency and potential conflicts of interest | Tackles the reasonableness gap by ensuring independence and objectivity |

| Expanded Auditor Responsibilities | Aligns audit practices more closely with stakeholder expectations | Reduces both the performance and evolution gaps |

| Greater Emphasis on Non-Financial Reporting | Addresses growing stakeholder interest in ESG (Environmental, Social, and Governance) issues | Bridges the evolution gap by including emerging areas of stakeholder interest |

| Increased Transparency in Audit Processes | Builds stakeholder confidence in the audit process through greater openness | Directly addresses the performance and reasonableness gaps |

- Educating the Public: Enhancing public understanding of the audit process and its limitations can reduce the reasonableness gap.

- Regulatory Changes: The UK could benefit from regulatory reforms that align auditing standards more closely with stakeholder expectations.

- Embracing Technology: Leveraging technology in audit processes can increase efficiency and transparency, thereby reducing the performance gap.

Table 2: Proposed regulatory changes and their potential impact table would offer a strategic overview of how these changes could help bridge the expectation gap.

Conclusion

Tackling the expectation gap in assurance is imperative for the integrity of the UK’s financial reporting landscape. By understanding the nature of this gap and implementing targeted strategies, the audit profession can enhance its credibility and meet the evolving expectations of its stakeholders. The journey towards narrowing this gap is ongoing, requiring the collective effort of auditors, regulators, businesses, and the public.

0 Comments