Blockchain and Cryptocurrency Valuation

- Posted by admin

- On January 24, 2025

- 0 Comments

Several industries, such as Software-as-a-Service (SaaS) and Financial Technology (FinTech), experienced significant growth in recent years, followed by downturns as a result of constrained investment and adverse macroeconomic conditions during the COVID-19 pandemic. However, no sector experienced a more pronounced rise and subsequent decline than the blockchain and cryptocurrency industry.

Fueled by immense interest and investments, the blockchain space was hailed as a revolutionary force in data security and finance, drawing comparisons to the internet’s transformative impact. However, the sector’s rapid growth, combined with unclear regulatory and technological frameworks, led to overinflated valuations and poorly vetted projects. The collapse of major players like FTX in 2022, alongside regulatory scrutiny from the SEC on other giants like Coinbase and Binance, highlighted governance failures and shook confidence in the industry, leading to a significant downturn.

Nonetheless, 2023 saw renewed optimism as regulatory bodies became more open to crypto-assets, and Bitcoin surged past its previous peak to over $70,000 following the SEC’s approval of the first cryptocurrency ETFs. This development opened the sector to a wider range of investors, driving new investment and provided second wind to the crypto assets sector.

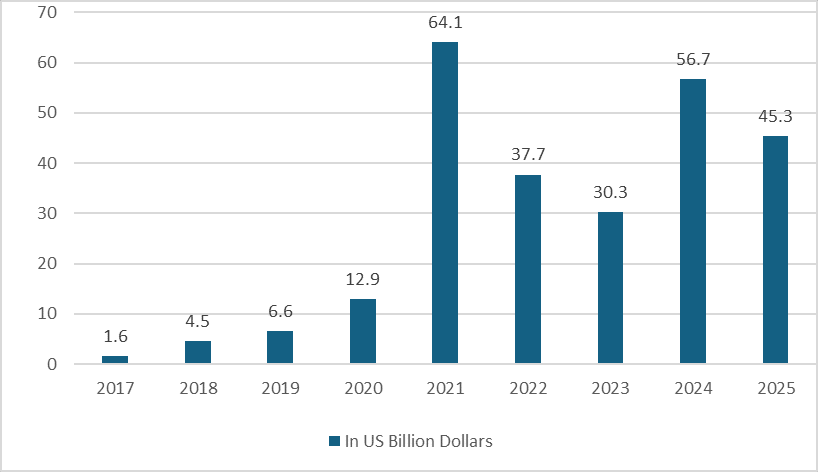

Moving forward, the cryptocurrency and blockchain markets are expected to experience significant growth by 2025, driven by rising adoption, increasing institutional interest, and advancements in blockchain technology. The global cryptocurrency market is projected to generate $56.7 billion in revenue by 2024, with a sharp decline expected in 2025, bringing the total to $45.3 billion. Despite this downturn, the U.S. remains the leading market, contributing nearly $9.8 billion in 2024. The number of global cryptocurrency users is anticipated to reach 861 million by 2025, reflecting growing adoption despite regulatory hurdles.

Global Cryptocurrency Revenue Growth

Despite Bitcoin’s price surge, investors are now exercising greater caution compared to the speculative enthusiasm of earlier years, as evidenced by targeted investments like those in the Global X Blockchain ETF, which focuses on public blockchain companies across various sectors.

Similarly, the global blockchain market is projected to see massive growth, reaching $608.6 million by 2025, largely driven by its use in non-financial sectors such as supply chain management, healthcare, and digital identity solutions. These industries are capitalizing on blockchain’s potential to enhance transparency, security, and efficiency.

The US is set to lead the global market, with revenue of $119.8 million in 2024, reflecting strong investor interest and digital infrastructure. By 2025, the number of NFT* users is forecasted to reach 11.64 million globally.

Moreover, the rise of Web 3.0 blockchain technologies is expected to significantly impact the market, with a forecasted value of $54.04 billion by 2031. The adoption of decentralized applications, smart contracts, and digital identity verification tools is likely to propel blockchain usage across various sectors in the US, UK, and beyond.

Classification of Crypto assets

To ensure a comprehensive discussion on valuation models and metrics for crypto assets, it is essential to distinguish between the various types of crypto assets. Key categories include cryptocurrencies, smart contract platforms, and decentralized applications (dApps), each of which has unique valuation drivers. All valuation models must account for the unique volatility, liquidity constraints, and regulatory uncertainties inherent to this asset class. While non-fungible tokens (NFTs) have gained popularity, limited empirical data restricts a detailed review of their valuation metrics. As the ecosystem evolves, further insights into their drivers may emerge. Nonetheless, the foundational components of cryptocurrencies, smart contract platforms, and decentralized applications provide a robust framework for analyzing the broader crypto asset landscape.

| Category | Example | Comparable Traditional Sector |

| Smart contract

platforms |

Ethereum (ETH), Solana (SOL), TRON (TRX), Cosmos (ATOM) | Information technology |

| Decentralized

applications |

Uniswap (UNI), Aave (AAVE), Compound

(COMP), Convex Finance (CVX) |

Finance |

| Cryptocurrencies | Bitcoin, Litecoin, Monero, Zcash,

Stellar, Dash, XRP |

Money |

The Key Concern

The major challenge in valuing crypto assets is their relatively short history. Bitcoin, for example, has only existed since 2009, while other cryptocurrencies like Litecoin and Ethereum were launched even more recently. In contrast, equity valuation models have been refined over decades. This short timeframe makes developing reliable valuation models for crypto assets difficult. As ongoing debate and discussion continue, the industry is working towards establishing a more universally accepted framework for evaluating crypto assets within the evolving digital finance ecosystem.

Valuation Models for Crypto assets

Smart Contract Platforms

Smart contract platforms, like Ethereum and Solana, facilitate the development and execution of decentralized applications (dApps) using native tokens. These platforms derive value from their technological infrastructure, scalability, transaction throughput, and developer ecosystem. The growth potential of dApps on these platforms contributes significantly to their long-term value, as they support various use cases, including decentralized finance (DeFi) and tokenized assets. Ethereum, the first platform, dominates the market with a significant share of the total value locked (TVL). However, alternatives like Solana, Cardano, and Avalanche have emerged, offering faster transaction speeds and lower fees to compete with Ethereum’s network congestion and high costs. These platforms play a crucial role in supporting decentralized finance (DeFi), gaming, and storage applications, contributing to the growth of the blockchain ecosystem.

Smart contract platforms have various use cases, such as peer-to-peer transactions and decentralized application operations. There are two main perspectives:

(i) Viewing the platform as a business, evaluating its native asset based on transaction fees as revenue

(ii) Viewing it as a network, valuing it through user growth and network effects. Lower transaction fees, under this second view, attract more users, potentially increasing overall value

Valuation of Blockchain as a Cash flow Asset

One approach to valuing blockchain platforms is to treat them as cash flow assets, where revenue is generated through selling block space for transactions. Users pay transaction fees, divided into base and priority fees, with the base fee often “burned” and the priority fee paid to validators. On Ethereum, these fees are measured in “gas,” where the cost fluctuates based on network demand. The base fee changes dynamically, while users can adjust the priority fee to expedite transaction processing. This valuation method varies depending on the platform’s specific characteristics.

Intrinsic valuation of Ethereum using the Discounted Cash Flow (DCF) model focuses on the present value of expected future cash flows. Ethereum’s cash flows consist of transaction fees and newly issued ETH, where fees are split into base (burned) and priority (rewarded to validators). The DCF model can estimate Ethereum’s value by accounting for both these cash flows and its token issuance. Analysts apply varying growth and discount rates to determine the present value, often comparing Ethereum’s burning mechanism to a stock buyback, which theoretically increases its value.

Valuation of Blockchain Platforms as a Network

When viewing blockchain platforms as networks, their native assets, like ether on Ethereum, function as the currency of a digital economy. As the network grows, so does the value of its currency, driven by increasing demand from users and developers. Metrics such as total value locked (TVL), developer activity, and active addresses help assess the health of a platform. More validators join as transaction fees and network activity rise, enhancing the platform’s security. This cyclical growth leads to higher token demand and potential price appreciation, creating a self-reinforcing network effect.

The decentralized and transparent nature of blockchain platforms allows participants to monitor performance and assess health through on-chain data, such as the number of active addresses and transaction fees. These on-chain metrics provide insights into demand, supply, and activity, offering a comparative analysis of smart contract platforms. Metrics like Total Value Locked (TVL) and developer activity indicate platform usage and future growth. Additionally, “tokenomics,” which includes factors like staking rewards, inflation, and token distribution, plays a key role in shaping the value and demand for a platform’s native token.

Cryptocurrency Valuation

Cryptocurrencies, such as Bitcoin and Ethereum, derive value from their adoption as stores of value or mediums of exchange. Their valuation is influenced by factors such as network security, market liquidity, and user adoption. Bitcoin, launched in 2009, is the leading crypto asset, commanding 46% of the total market capitalization as of June 2023. One common method for valuing Bitcoin is the Total Addressable Market (TAM) approach, which compares Bitcoin to assets like gold, M2 money supply, and global remittances. This method estimates Bitcoin’s potential value based on its ability to capture a portion of these markets as a unit of account, store of value, or medium of exchange.

For example, if Bitcoin were to capture a portion of the global remittances market, currently valued at $794 billion, its potential value would be calculated using the formula:

Bitcoin Value= (Level of penetration × Value of target market) / Fully diluted supply

The fully diluted supply of Bitcoin is capped at 21 million, which plays a crucial role in calculating its projected value. Using the TAM approach, Bitcoin’s potential valuation can vary depending on how much of each market it captures. For instance, its potential value is significantly influenced by its capacity to serve as a medium of exchange in remittances or a store of value similar to gold.

However, the TAM approach assumes that Bitcoin will capture parts of these markets, an outcome that has yet to be fully realized. Moreover, this method does not account for competition from other cryptocurrencies or the future growth of these markets, which could further influence Bitcoin’s valuation. Thus, while the TAM approach offers valuable insights, it relies on speculative assumptions about Bitcoin’s role in the broader financial landscape.

Conclusion

Valuing blockchain platforms and cryptocurrencies remains a complex and evolving process. Traditional methods such as the DCF model can be adapted to blockchain by considering cash flows from transaction fees and token issuance. However, the speculative nature of the market, combined with its short history and evolving regulatory landscape, makes valuation a challenge. As blockchain technology and Web 3.0 applications continue to develop, the industry is likely to move toward more standardized and reliable valuation frameworks. Despite these challenges, the future of blockchain and cryptocurrency appears promising, with strong growth expected across various sectors, driven by increasing institutional interest, technological advancements, and broader adoption.

0 Comments